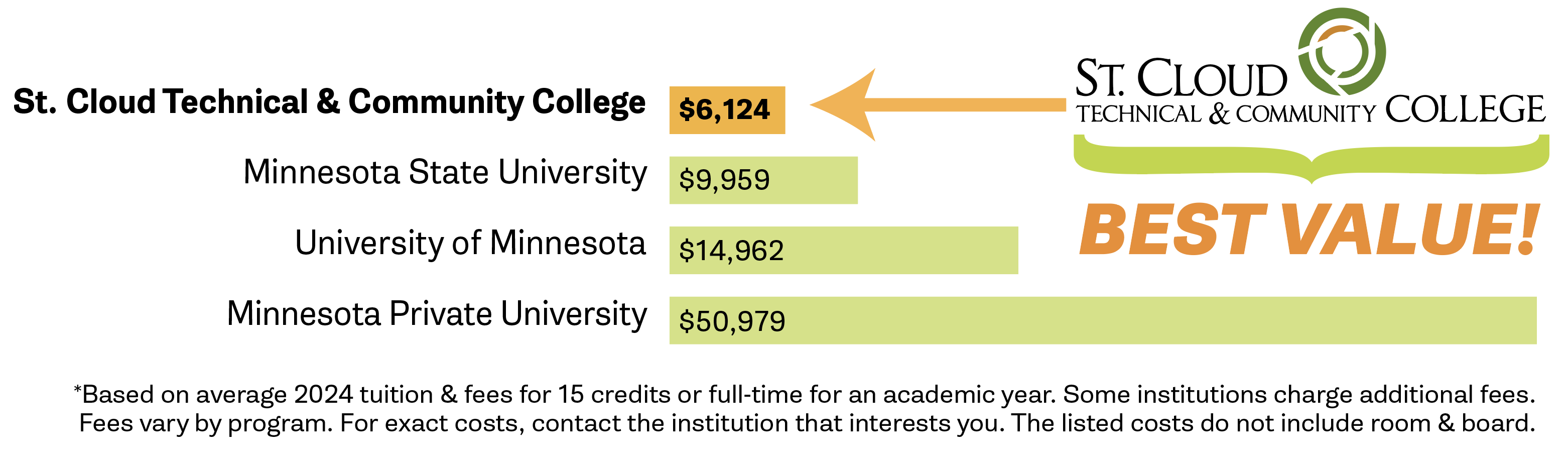

Paying for college truly is an investment in your future, and SCTCC is one of the best values out there.

While attending college and earning a degree means better job options and bigger paychecks, paying for that investment can be a challenge.

Financial Services is here to help: learn more about types of loans and grants, rights and responsibilities of aid recipients, federal and college policies about awards, and steps to get started applying for financial aid.

Financial Aid Application Process

Financial aid is monetary assistance to help you meet some of the expenses of going to college. Aid may be in the form of grants, loans, scholarships, employment opportunities, or a combination of these.

More than 80% of SCTCC students receive some form of financial aid, and the SCTCC Financial Services staff and the SCTCC Foundation are committed to helping you identify financial aid options that are appropriate for you.

Loans are repayable awards and the most common form of financial aid. Students who complete the FAFSA (SCTCC code 005534)may be eligible for the Federal Direct Stafford Loan. Parent Loans for Undergraduate Students (PLUS) and Private Loans are also available.

Scholarships & Grants consist of institutional, state, federal, or outside sources of funding that do not need to be repaid. Scholarships and grants are based on many things, including program of study, merit, financial need, a student’s hometown, and other things. Complete the SCTCC Foundation scholarship application.

Work Study is an opportunity for employment for students with demonstrated financial need. In essence, it is the possibility for you to work up to 20 hours per week to earn money. Earnings can be used to help pay your living expenses or to help pay tuition. For more information, please visit the Student Employment desk of the SCTCC Financial Aid Office.

Satisfactory Academic Progress

Your academic standing can affect your standing as a student as well as your financial aid. Make sure you maintain the number of credits completed and GPA needed. More information on Academic Standing and Progress.

For Undocumented Students:

The MN Dream Act will provide certain benefits to undocumented students who meet the following criteria:

- Attended a Minnesota high school for at least 3 years; and

- Graduated from a Minnesota high school or earned a GED in Minnesota; and

- Registered with the U.S. Selective Service (applies only to males 18 to 25 years old); and

- Provide documentation to show they have applied for lawful immigration status but only if a federal process exists for a student to do so (does not include applying for Deferred Action for Childhood Arrivals - DACA). There is currently not a federal process in place, so this documentation is not currently required.

Visit the Minnesota Dream Act application at the Office of Higher Education site for more info and an application.

Veterans Benefits

Are you a veteran, active servicemember, or family member of a veteran? You may be eligible for benefits that will help you pay for college costs.

Questions? Contact:

Northway 1-401

1540 Northway Drive

St. Cloud, MN 56303